Roth IRA: Created in 1997, this sort of retirement savings makes it possible for publish-tax contributions without a direct tax deduction; in its place, experienced withdrawals in retirement is usually tax-free of charge.

The process involves obtaining and transferring gold to your depository wherever a custodian can safeguard it, necessitating collaboration with a dependable and trustworthy gold IRA company.

One of many initial getting that you've got to order it with taxed cash flow. With a gold IRA, you happen to be generating the investment without tax currently being paid out upfront. An additional benefit is that the storage is safe and guaranteed when you use a gold IRA custodian.

Gold has very long been noticed as a safe haven, furnishing protection from financial instability and forex devaluation. Individuals wanting to safeguard their retirement portfolios may possibly consider opening a gold IRA.

Considering that precious metals are considered collectibles, they must meet up with Particular demands to become allowed in IRA accounts.

There are some other quite common sorts of IRAs, the commonest staying a conventional IRA or a Roth IRA. Even though they won't Allow you to immediately invest in physical precious metals, dependant upon your requirements, they might function likewise.

Impartial critique web pages devoted solely to evaluating different gold IRA companies are credible resources well worth exploring when investigating about investing in precious metals for retirement plans.

Furthermore, internet you've other available choices such as investing in gold miners or using futures and choices for exposure to gold.

Augusta goes the extra mile by overtly disclosing their margin on gold and silver revenue, sharing refreshingly sincere numbers that expose markups of around ten% for prevalent bullion and 66% or greater for quality products and solutions.

When picking your custodian or gold group, you should definitely inquire as to their obtainable precious metals choices as well as any involved fees.

Go with a Reputable Custodian: According to IRS guidelines, individuals are not able to continue to keep gold from their IRA in the home – you will require the two a skilled custodian and depository to manage and keep it safely and securely to suit your needs.

It can be crucial to exercising caution as there happen to be reports and warnings regarding selected companies that supply gold IRAs, such as draining customer accounts by concealed costs or advertising riskier investment items.

Goldco’s customer-centric method has attained them superb gold IRA reviews on various online platforms. Nevertheless, In terms of crucial information and facts, the website falls brief in giving certain aspects.

It is possible to discover every little thing important for prosperous gold IRA investments, from your account rollover system to qualified precious metals and storage methods.

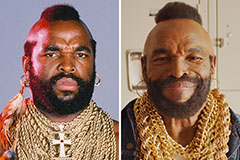

Mr. T Then & Now!

Mr. T Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!