CFDs are intricate instruments and include a significant risk of getting rid of cash rapidly because of leverage. CFDs are complex devices and have a significant risk of losing funds quickly on account of leverage.

Investments in non-public placements are speculative and involve a substantial diploma of risk and those traders who can't manage to get rid of their entire investment should not commit. Moreover, buyers might get illiquid and/or limited securities That could be topic to holding time period requirements and/or liquidity issues.

Gains from an ETF holding precious metals will be taxed in the collectibles level, when Electricity commodity ETFs are structured as constrained partnerships, so you will get a K-one form annually at tax time.

Commodities are traded both of those in spot markets and futures markets. Just like other spot selling prices, the spot charge is the cost for your commodity today.

ETFs are funds that trade on an Trade like a inventory. They are really an simple to operate, affordable and tax productive way to invest dollars and are extensively out there Fee totally free on most on-line brokerage accounts and thru fiscal advisors. Learn the way to get ETFs.

These merchandise use credit card debt and derivatives, such as choices or futures contracts, to leverage their returns.

Spot rates are the costs of physical or financial assets in a very transaction for speedy settlement.

Not like potential price ranges, that happen to be motivated by anticipations and contracts for later supply, such a pricing is centered on the existing.

An ETF is meant to monitor as intently as feasible the price of an index or a group of fundamental assets. In this article’s how it works: A monetary products and services business purchases a basket of assets—shares or bonds, currencies or commodity futures contracts—that comprise the fund.

Specially, a ahead fee is determined by three aspects: its underlying spot fee, interest charge differential, and the contract’s the perfect time to expiry.

Accessing accurate and well timed spot rate knowledge is important, as even compact discrepancies can have substantial monetary outcomes. The solutions for getting this details differ by asset class but usually contain general public and proprietary resources.

In addition, traders invest in and sell ETF shares with other investors on an exchange. Therefore, the ETF manager doesn't have to offer holdings — perhaps building funds gains — to satisfy investor redemptions.

Some ETFs more tips here have tracking mistake: Share costs may possibly diverge excessively from the costs of fundamental assets or indexes

A spot price is set based upon just what the events concerned are handy with. It's the cost established based on the rate that a buyer is willing to pay back and the value that the vendor is prepared to take from prospects. It may differ with time and put.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Ralph Macchio Then & Now!

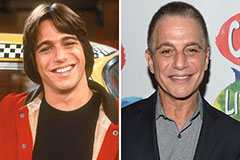

Ralph Macchio Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!